Learning about Medicare Advantage Plans

Medicare Advantage Plans represent provided by independent Insurance carriers that contract with Medicare to deliver Part A not to mention Part B protection in one combined format. Unlike traditional Medicare, Medicare Advantage Plans commonly offer additional benefits such as drug coverage, dental care, vision services, in addition to health support programs. Such Medicare Advantage Plans function within established service areas, so location a important element during comparison.

How Medicare Advantage Plans Compare From Original Medicare

Traditional Medicare provides open provider choice, while Medicare Advantage Plans generally operate through Medicare Advantage Plan option organized networks like HMOs and PPOs. Medicare Advantage Plans may involve provider referrals along with in-network doctors, but they commonly counter those restrictions with consistent out-of-pocket amounts. For many beneficiaries, Medicare Advantage Plans provide a blend between budget awareness & added benefits that Traditional Medicare independently does not usually provide.

Who May want to Consider Medicare Advantage Plans

Medicare Advantage Plans appeal to beneficiaries looking for coordinated care not to mention potential cost savings under one unified plan structure. Beneficiaries living with ongoing health conditions often select Medicare Advantage Plans because connected treatment structures simplify ongoing care. Medicare Advantage Plans can further attract people who want bundled benefits without handling separate secondary policies.

Qualification Guidelines for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, enrollment in Medicare Part A plus Part B must be completed. Medicare Advantage Plans are available to the majority of beneficiaries aged 65 alternatively older, as well as under-sixty-five people with eligible disabilities. Enrollment in Medicare Advantage Plans depends on living status within a plan’s service area as well as enrollment timing that matches permitted registration timeframes.

Best times to Choose Medicare Advantage Plans

Timing plays a vital function when selecting Medicare Advantage Plans. The Initial Enrollment Period surrounds your Medicare eligibility milestone as well as enables initial selection of Medicare Advantage Plans. Skipping this timeframe does not necessarily eliminate access, but it often change future options for Medicare Advantage Plans later in the year.

Annual not to mention Qualifying Enrollment Periods

Each fall, the Yearly enrollment window allows enrollees to change, drop, and/or enroll in Medicare Advantage Plans. Special enrollment windows open when life events happen, such as moving and/or coverage termination, enabling changes to Medicare Advantage Plans beyond the typical timeline. Recognizing these periods ensures Medicare Advantage Plans remain within reach when conditions change.

How to Review Medicare Advantage Plans Effectively

Reviewing Medicare Advantage Plans involves care to more than recurring payments alone. Medicare Advantage Plans vary by provider networks, annual spending limits, drug lists, with coverage guidelines. A careful review of Medicare Advantage Plans helps matching medical needs with plan structures.

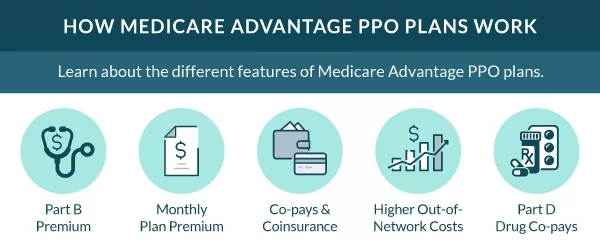

Costs, Coverage, with Provider Networks

Monthly costs, copayments, not to mention annual maximums all shape the value of Medicare Advantage Plans. Some Medicare Advantage Plans feature low monthly costs but higher cost-sharing, while alternative options emphasize stable spending. Doctor availability also changes, making it important to confirm that regular providers accept the Medicare Advantage Plans under consideration.

Drug Coverage as well as Extra Services

Numerous Medicare Advantage Plans include Part D prescription coverage, streamlining medication handling. Beyond prescriptions, Medicare Advantage Plans may include wellness programs, transportation services, and also OTC allowances. Evaluating these features ensures Medicare Advantage Plans align with ongoing medical requirements.

Joining Medicare Advantage Plans

Registration in Medicare Advantage Plans can happen digitally, by phone, even through licensed Insurance professionals. Medicare Advantage Plans call for precise individual details along with verification of qualification before coverage activation. Submitting enrollment accurately prevents delays alternatively unexpected benefit interruptions within Medicare Advantage Plans.

Understanding the Importance of Authorized Insurance Agents

Authorized Insurance Agents support clarify plan details with explain distinctions among Medicare Advantage Plans. Connecting with an expert can address network restrictions, benefit limits, also costs tied to Medicare Advantage Plans. Expert assistance commonly simplifies decision-making during enrollment.

Typical Errors to Watch for With Medicare Advantage Plans

Ignoring doctor networks remains among the frequent issues when selecting Medicare Advantage Plans. Another issue involves concentrating only on monthly costs without reviewing annual spending across Medicare Advantage Plans. Examining plan documents carefully prevents confusion after sign-up.

Reevaluating Medicare Advantage Plans Every Coverage Year

Medical priorities evolve, as well as Medicare Advantage Plans change every year as part of that process. Evaluating Medicare Advantage Plans during annual enrollment permits adjustments when coverage, expenses, and/or doctor access shift. Regular review ensures Medicare Advantage Plans consistent with present medical priorities.

Reasons Medicare Advantage Plans Keep to Increase

Participation patterns indicate increasing demand in Medicare Advantage Plans nationwide. Broader benefits, predictable out-of-pocket limits, together with coordinated healthcare delivery contribute to the growth of Medicare Advantage Plans. As offerings expand, educated evaluation becomes increasingly important.

Ongoing Value of Medicare Advantage Plans

For numerous enrollees, Medicare Advantage Plans offer stability through integrated coverage along with organized care. Medicare Advantage Plans can minimize management burden while supporting preventive services. Identifying well-matched Medicare Advantage Plans creates confidence throughout retirement years.

Evaluate plus Sign up for Medicare Advantage Plans Today

Taking the next step with Medicare Advantage Plans begins by reviewing current choices & confirming qualification. If you are currently entering Medicare and revisiting current benefits, Medicare Advantage Plans offer adaptable coverage options built for different medical needs. Explore Medicare Advantage Plans now to secure coverage that aligns with both your health as well as your financial goals.